Action to Implement Management that is

Conscious of Cost of Capital and Stock Price

Updated on May 23, 2025

- Status of Relevant Initiatives /

- Management Conscious of Cost of Capital and Stock Price: Analysis of Current Situation /

- Current Analysis of Capital Costs and Share Prices /

- Current Analysis of PBR /

- Balance Sheet Analysis /

- Approach Toward Corporate Value Enhancement /

- Medium-Term Management Plan 2027: Numerical Targets /

- Cash Allocation /

- Shareholder Return /

- Key Points of Business Strategy and Non-Financial Strategy /

- IR

Status of Relevant Initiatives

Management Conscious of Cost of Capital and Stock Price: Analysis of Current Situation

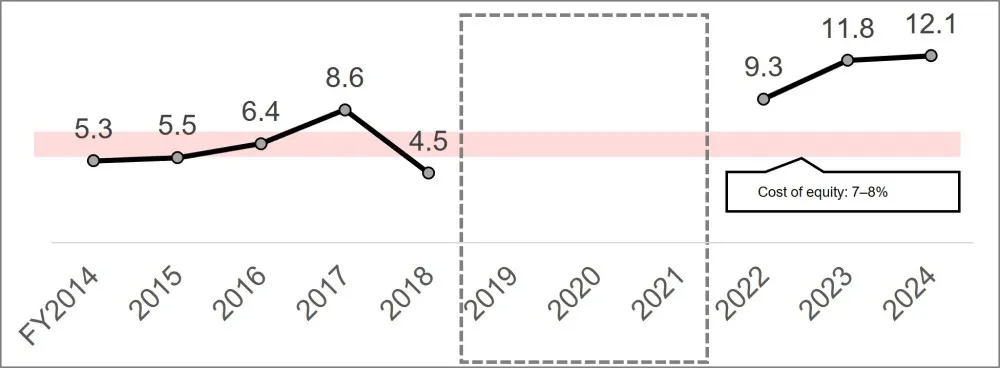

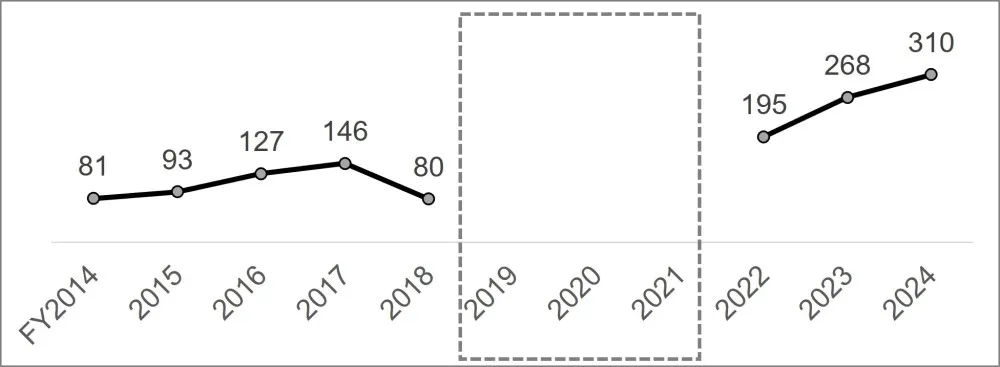

- ROE and EPS improved mainly due to an increase in operating profit and the sale of cross-shareholdings

- Share price growth has stalled, our PBR is below 1.0, and our PER remains low

-

ROE (%)

-

EPS (JPY)

-

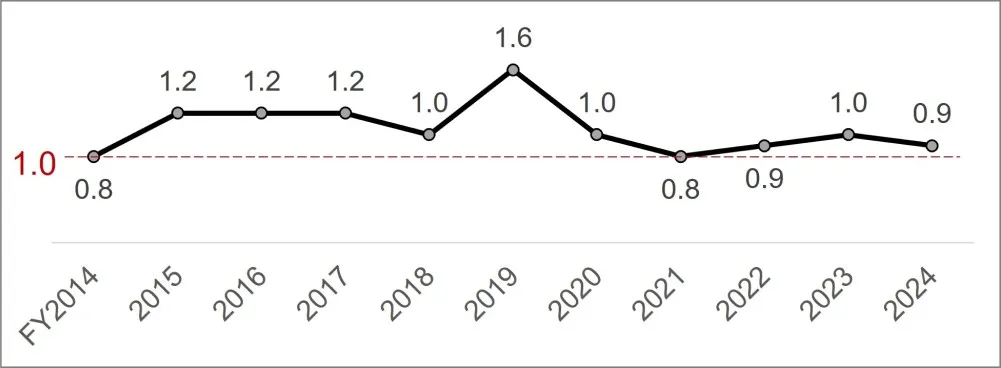

PBR (Multiples)

-

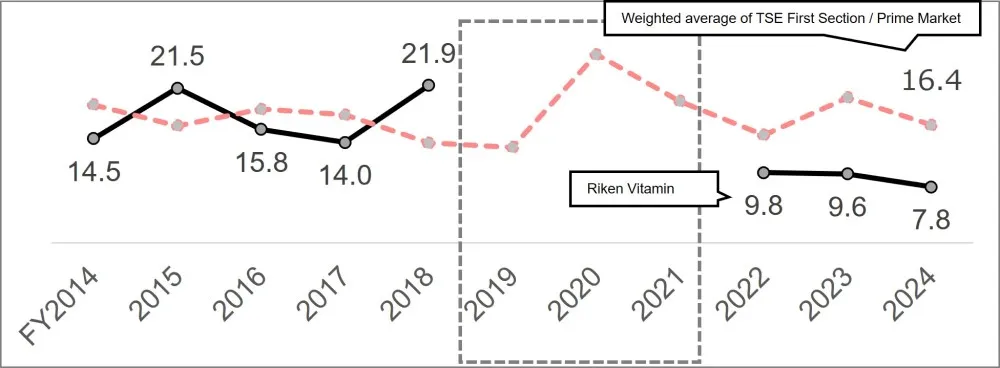

PER (Multiples)

- Calculated based on actual fiscal year-end results

- The area enclosed by the dashed lines is excluded due to losses and/or abnormal values resulting from accounting issues associated with a subsidiary

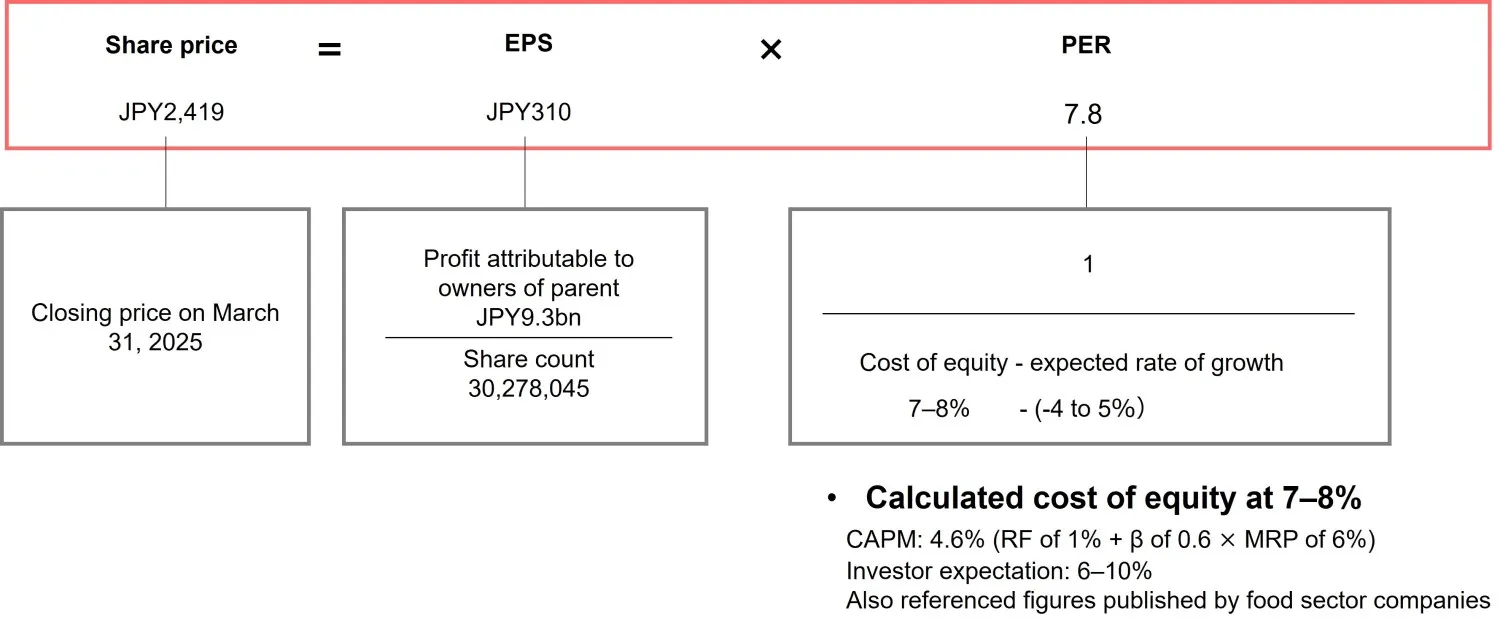

Current Analysis of Capital Costs and Share Prices

- Driven by profit growth and share buybacks, EPS grew 3.8-fold over the past 10 years

- Meanwhile, our share price the share price rose only 1.2-fold during the same period. Our analysis attributes this gap to negative growth expectations

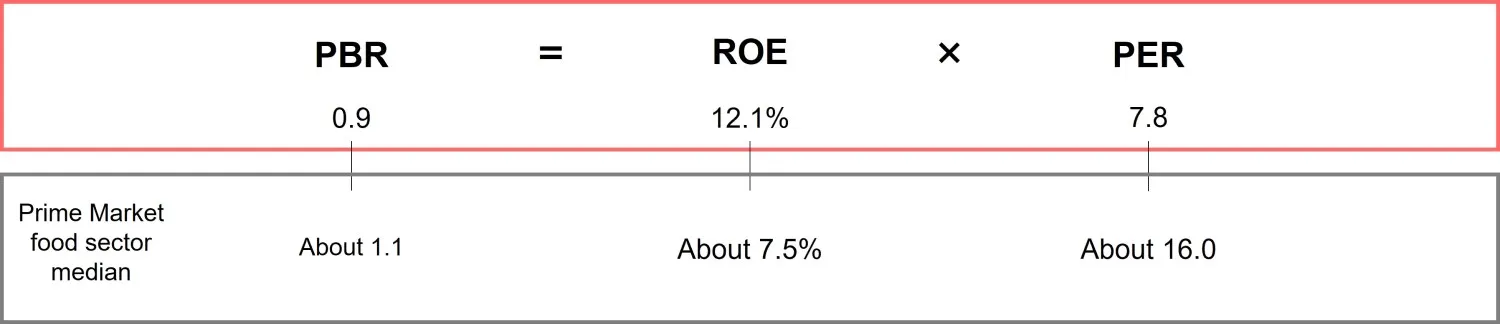

Current Analysis of PBR

- Our return on capital is high compared to sector peers; issues are attributable to our PER, which reflects market expectations

- Our analyses indicate low market expectations are due to perceptions of our growth potential, scale, liquidity, and approach to capital market engagement

Factors behind low expectations (issues raised during meetings with investors)

-

Growth potential of

domestic food market -

Market

capitalization -

Share

liquidity -

Balance sheet

management -

Conservative earnings

projections

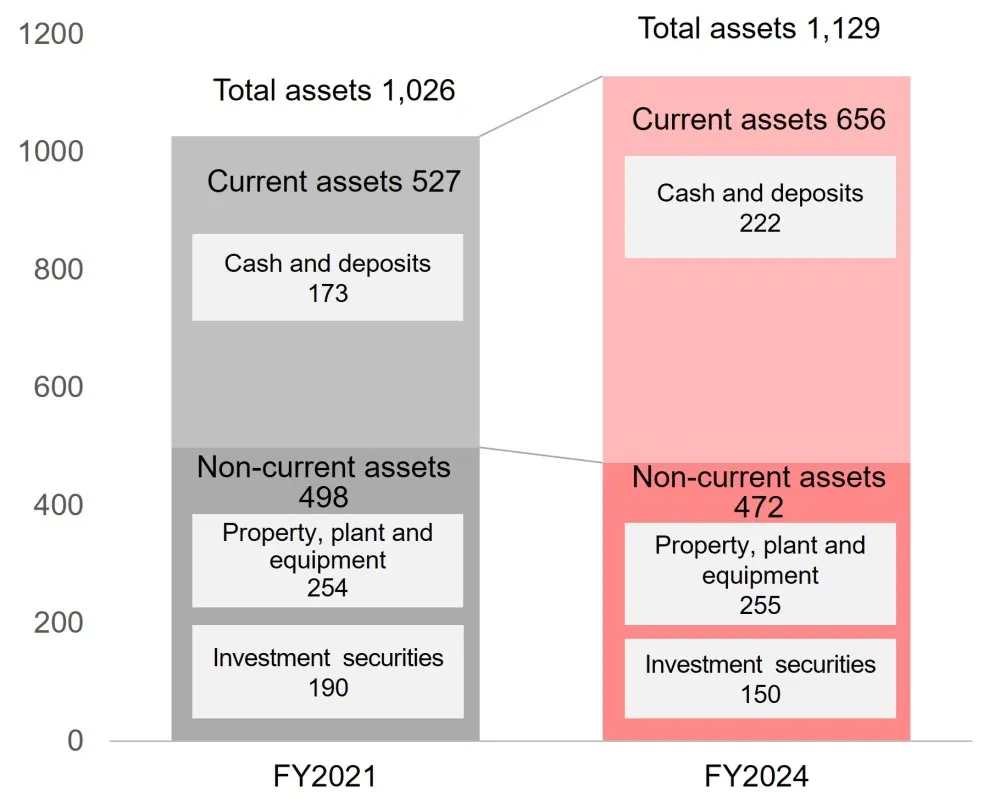

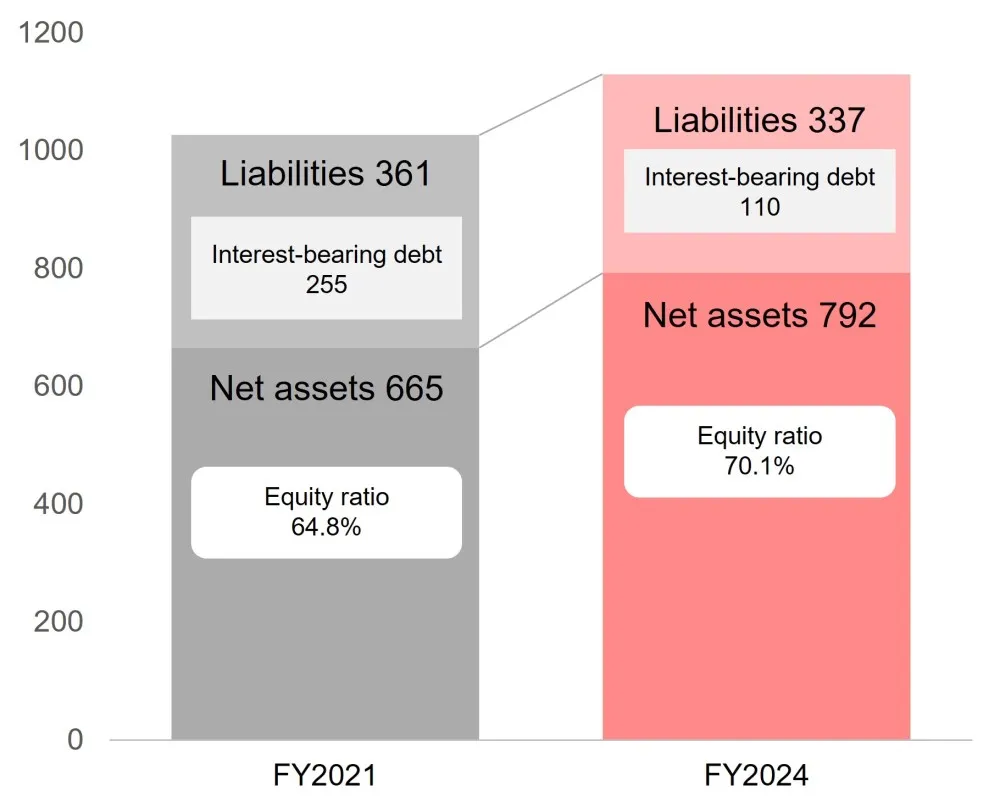

Balance Sheet Analysis

- Investment securities decreased over three years while property, plant, and equipment remained level and current assets increased

- Provided shareholder return of JPY14.0bn (JPY7.0bn in dividends and JPY7.4bn through share buybacks) and generated equity ratio increase of 5pp

-

■ Assets

-

■ Liabilities / Net Assets

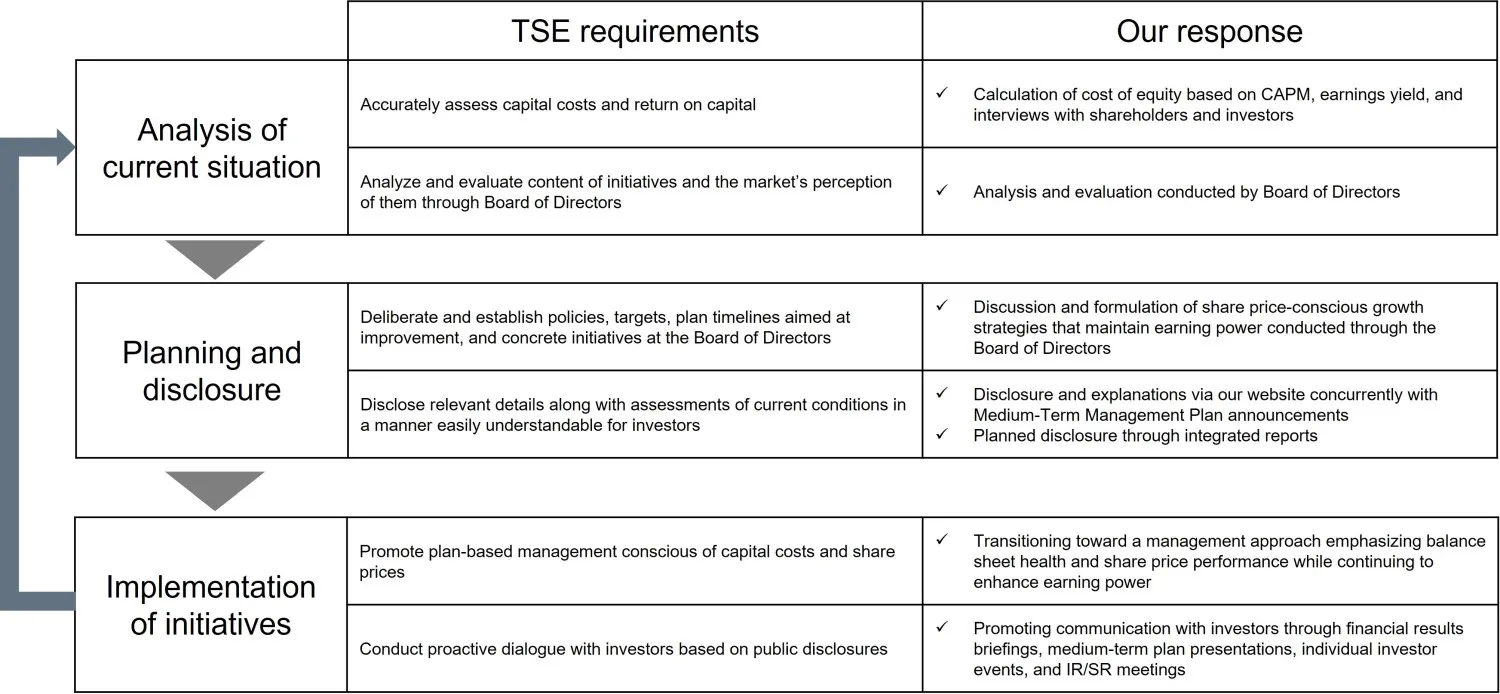

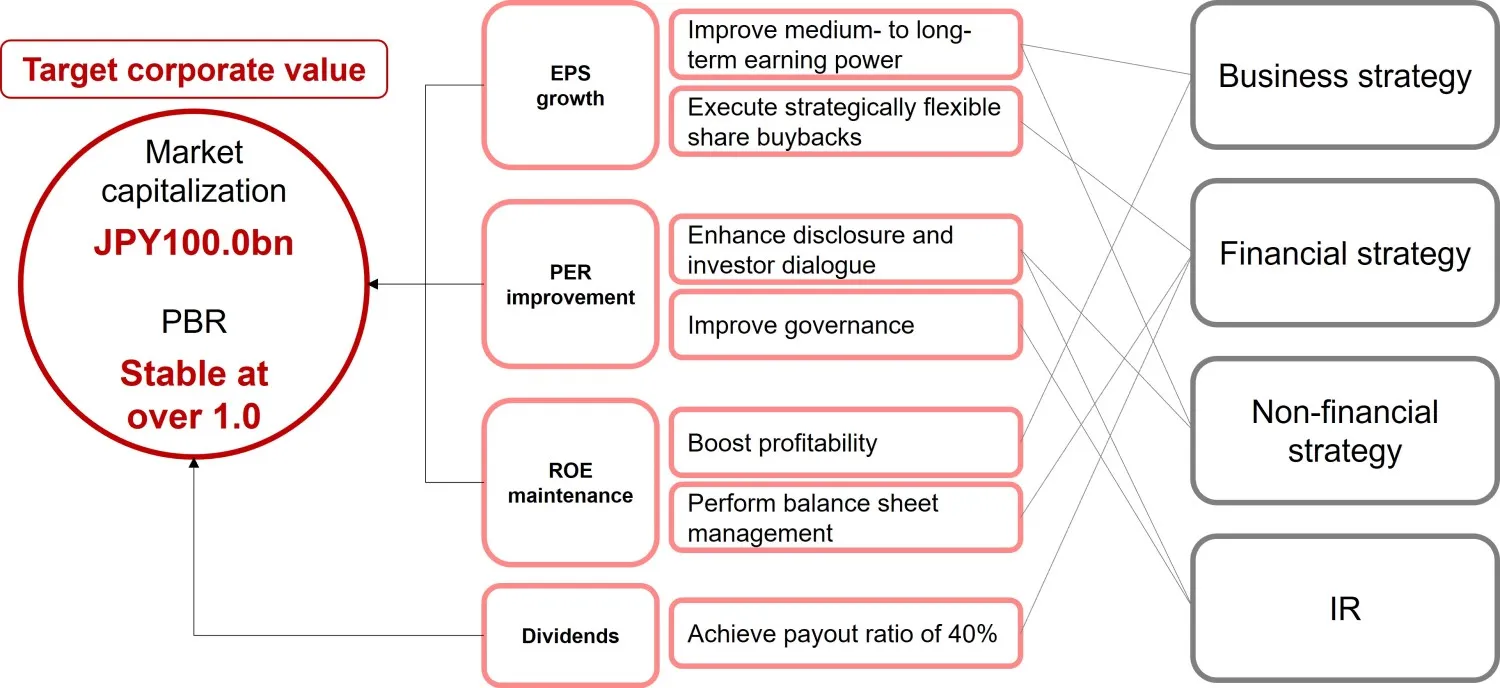

Approach Toward Corporate Value Enhancement

- Our PER is one of our most pressing strategic priorities

- We aim to raise our anticipated rate of growth by improving earnings momentum (EPS), maintaining ROE, and strengthening investor communication

Medium-Term Management Plan 2027: Numerical Targets

| KPIs | FY2024 actual |

FY2027 target |

|

| Growth potential | Net sales | 95.5 | 110.0 |

|---|---|---|---|

| Profitability | Operating profit Operating profit margin |

8.7 9.1% |

10.0 9.1% |

| EBITDA (Operating profit + depreciation) | 11.9 | 14.2 | |

| Efficiency | ROE | 12.1% | 10% or more |

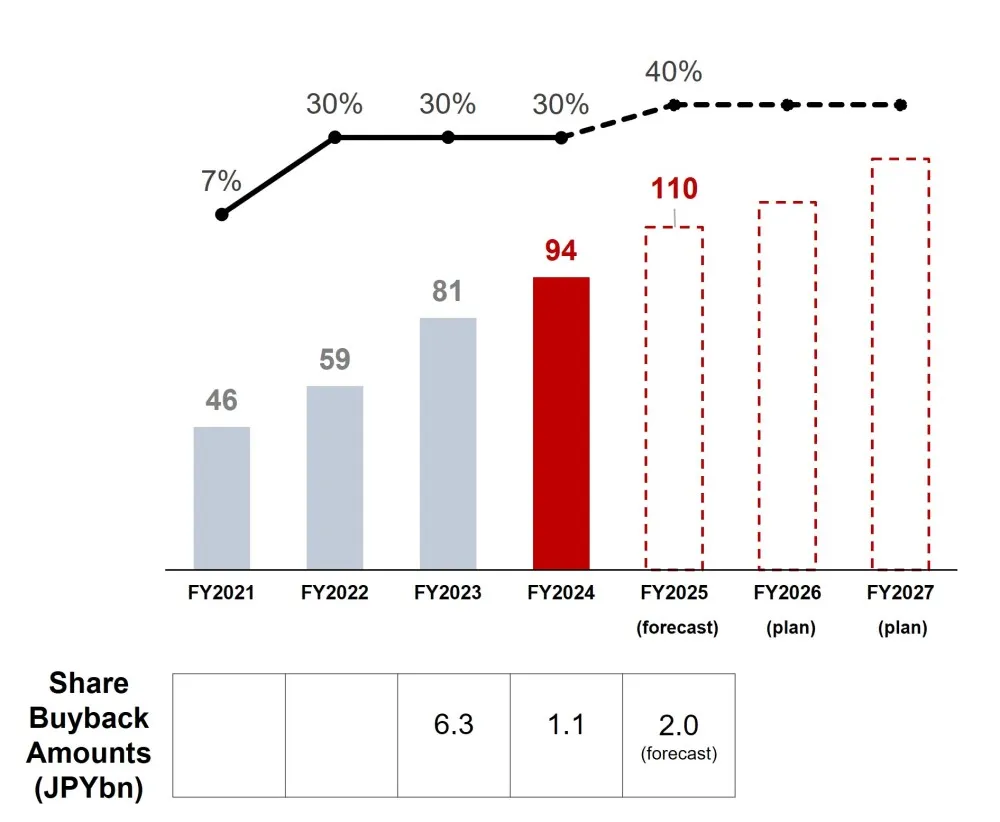

| Shareholder return | Payout ratio | 30.3% | 40% or more |

| Financial discipline | Shareholder equity ratio | 70.1% | 60–65% |

| Governance | Cross-shareholdings to net assets ratio | 19.0% | Less than 10% |

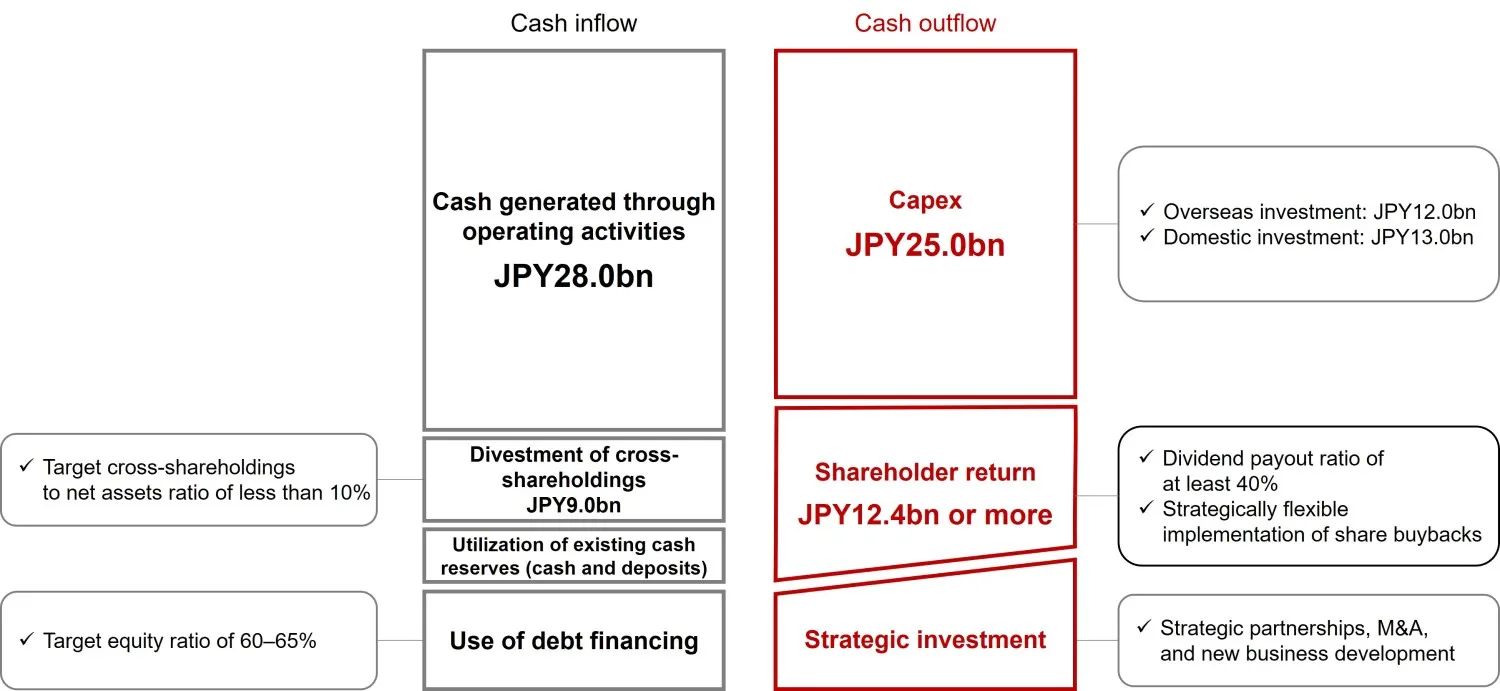

Cash Allocation

- Leveraging cash from operations and divestments of cross-shareholdings, we will proactively invest while enhancing shareholder return

- When deemed in alignment with strategic needs or objectives, we will selectively utilize debt to finance strategic investments

Shareholder Return

- We have raised our target consolidated dividend payout ratio

- The Company will execute share buybacks with strategic flexibility

-

■ Dividend policy

Consolidated dividend payout ratio of

at least 40%■ Share buybacks

Conduct with strategic flexibility when deemed appropriate

A FY2025 budget of JPY2.0bn has been allocated for share buybacks

-

■ Dividends per Share (JPY) and Dividend Payout Ratio

Key Points of Business Strategy and Non-Financial Strategy

| Business strategy |

|

| Non-financial strategy |

|

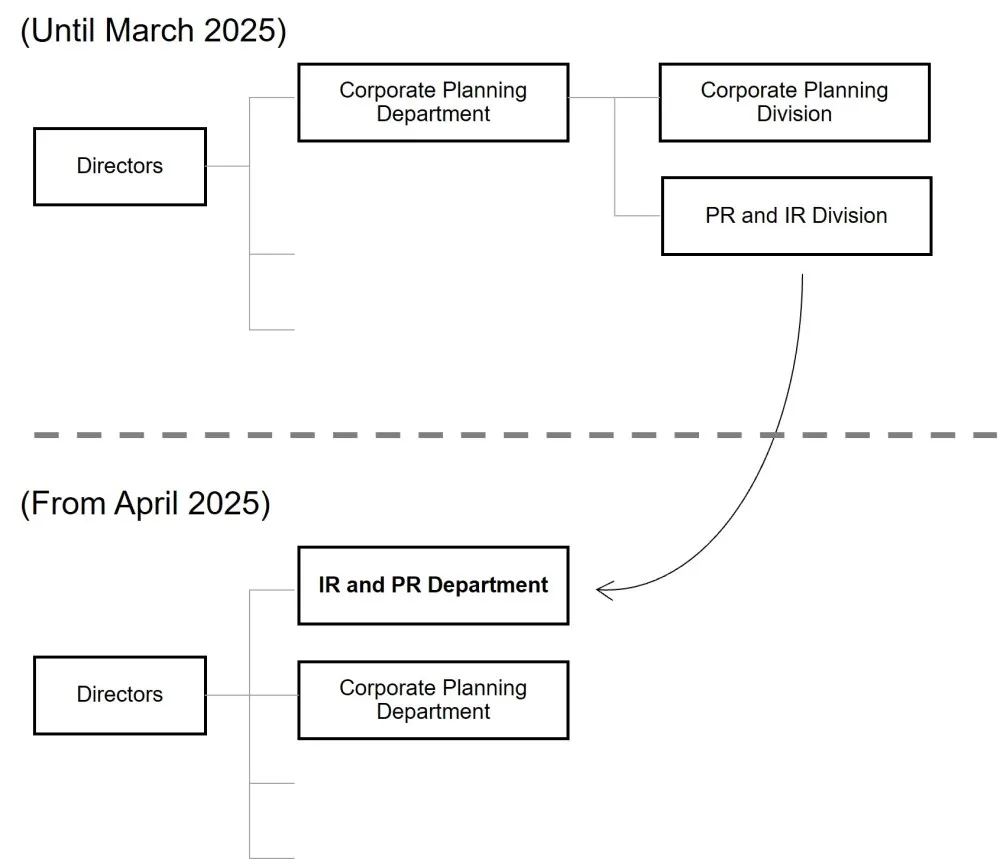

IR

- Under our previous medium-term plan, we established a suitable platform as a Prime Market-listed company

- Under Medium-Term Management Plan 2027, we will reassess the strategic importance we ascribe to IR internally while striving to ensure a fair market valuation of our stock

■ Activities of Previous Medium-Term Plan

Steadily expanded our range of activities

| Results achieved over three years | |

|---|---|

| Disclosure enhancement |

|

| Improving communication with investors |

|

| Feedback for management |

|

■ Adjustment of IR System