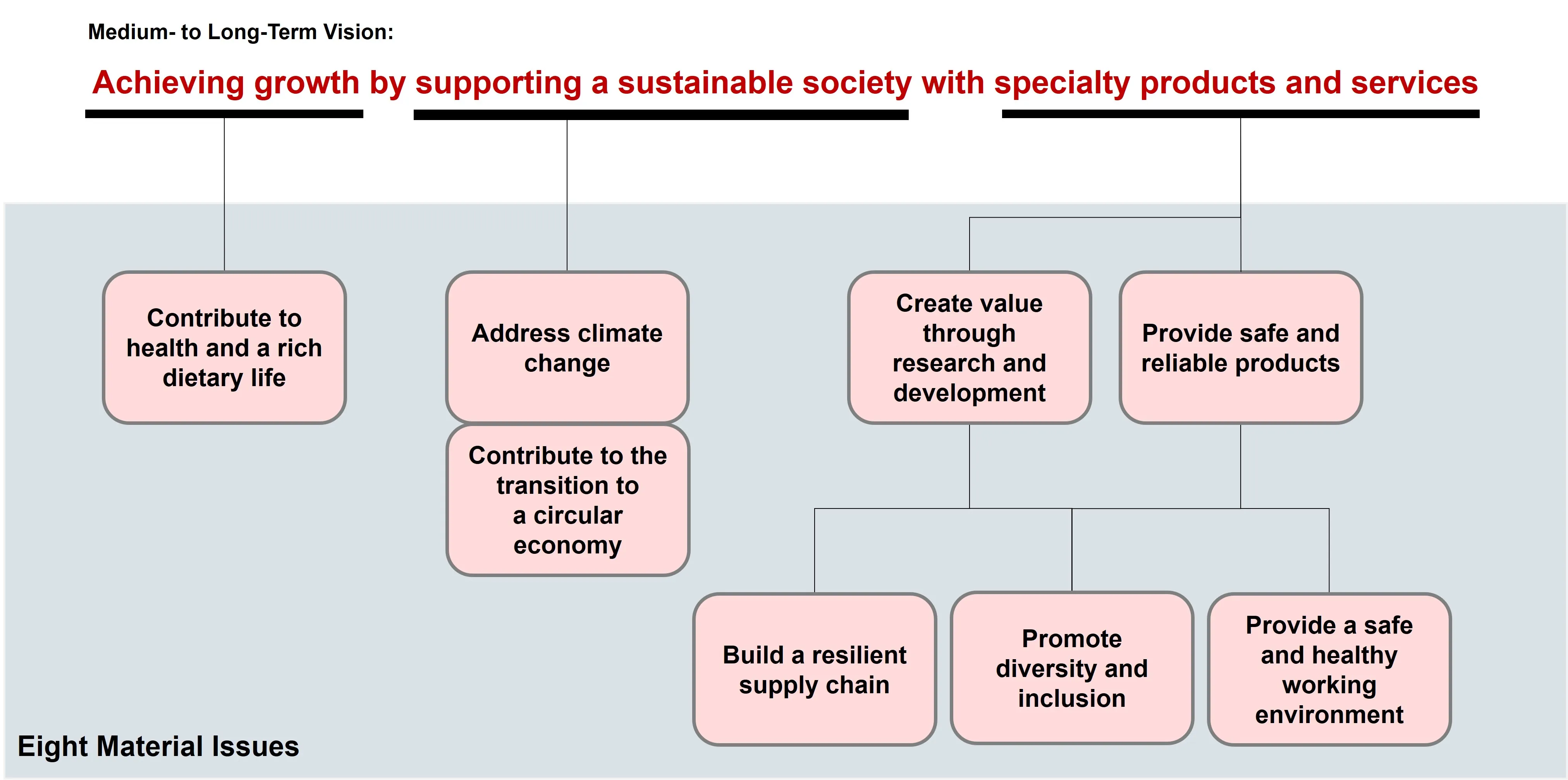

Medium- to Long-Term Vision

Medium-Term Management Plan 2027

Medium- to Long-Term Vision

Achieving growth by supporting a sustainable society with specialty products and services

Since our founding, we have focused our activities on “making effective use of natural materials” under our management philosophy of helping to enrich our society through healthy, enjoyable foods. In light of these philosophies and the shifting business landscape, we established our medium- to long-term vision in 2022.

Review of previous Medium-Term Management Plan (FY2022–2024)

Under its previous Medium-Term Management Plan, the Group concentrated on four strategic pillars: strengthening management foundation (governance), accelerating expansion in Asia and North America, delving into the domestic market, and entering new domains, and pursuing sustainability-focused management. Through its adherence to these strategic pillars, the Group successfully achieved all performance targets.

Following a significant decline caused by accounting issues emerging during 2020 in association with an overseas subsidiary, our share price rebounded to levels observed prior to these issues. However, our share price has since stagnated, and the Group’s PBR has remained below 1.0.

Progress Toward Performance Goals

- Achieved all performance targets

- Profit attributable to owners of parent significantly exceeded our forecast due in part to the sale of cross-shareholdings

| FY2021 actual |

FY2024 actual |

FY2024 initial forecast |

|

| Net sales | 79.2 | 95.5 | 94.0 |

| Operating profit | 5.8 | 8.7 | 8.0 |

| Operating profit margin | 7.4% | 9.1% | 8.5% |

| Ordinary profit | 6.1 | 9.4 | 8.2 |

| Profit attributable to owners of parent | 21.5* | 9.3 | 6.5 |

| ROE | 38.3%* | 12.1% | 8.0% or more |

| Cross-shareholdings to net assets ratio | 28.7% | 19.0% | Less than 20% |

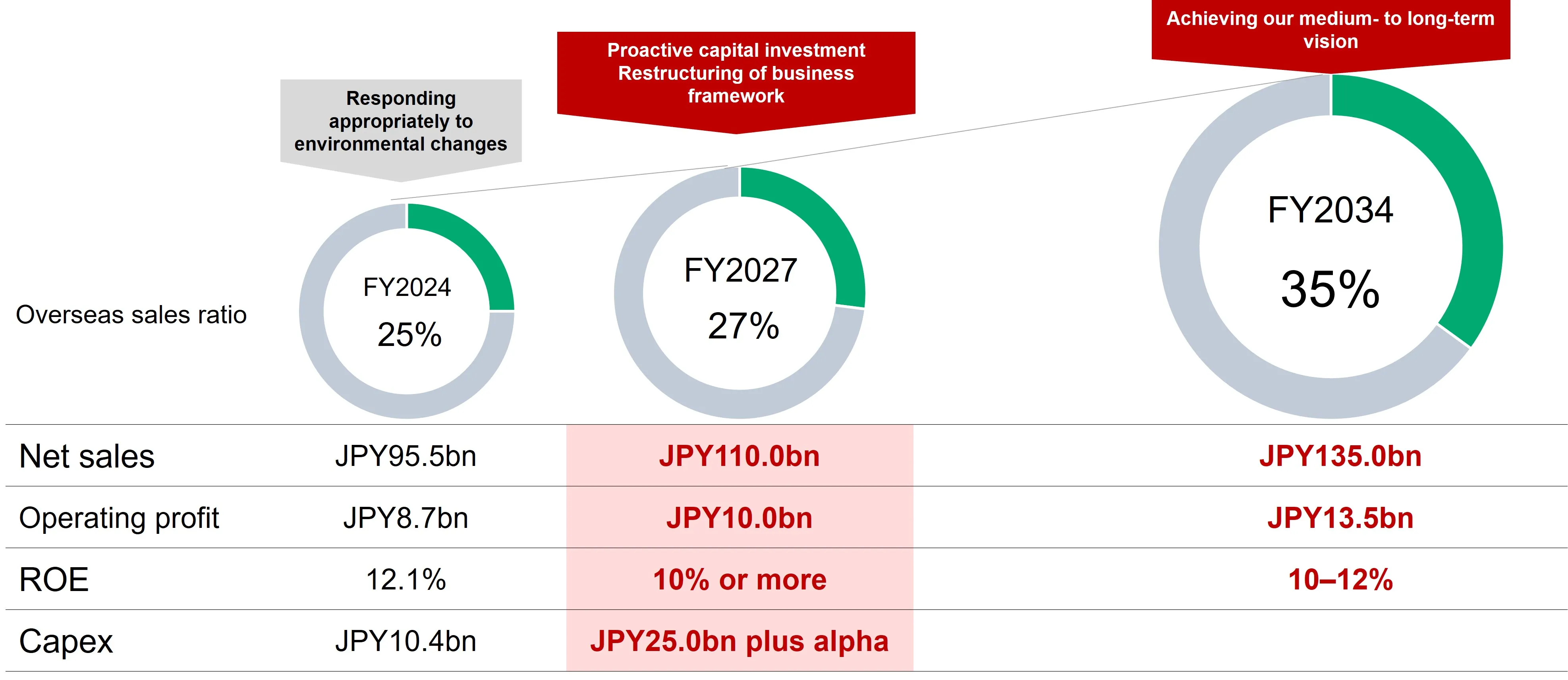

Medium-Term Management Plan 2027

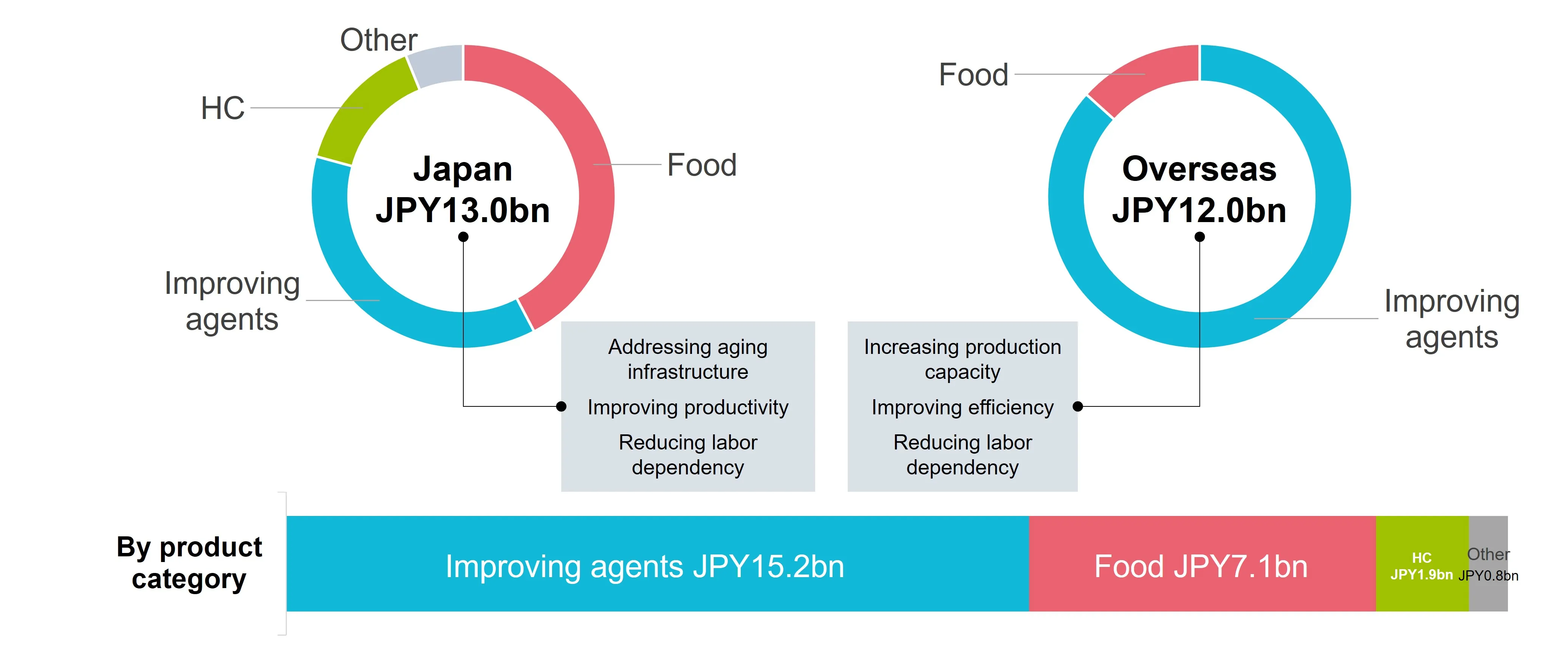

The Company has updated its Medium- to long-term vision and now targets JPY13.5bn in operating profit, an overseas sales ratio of 35%, and ROE of 10–12% for FY2034. To facilitate achievement of these targets, Medium-Term Management Plan 2027 includes capex of JPY25.0bn—2.5 times the capex of our previous plan. Meanwhile, in Japan, we will prioritize investment targeting productivity and labor dependency reduction to address aging infrastructure and manpower shortages. Overseas, we will invest in the expansion of specialty product production while establishing a foundation for future growth while establishing a foundation for future growth through cross-border integration and collaboration among production, sales, development, and administrative functions.

Alongside these initiatives, we will transition toward a management approach prioritizing our balance sheet and share price while promoting constructive dialogue with shareholders and the investment community with the aim of enhancing our Medium- to long-term corporate value.

Strategic Positioning of Medium-Term Management Plan 2027

Medium-to Long-Term Vision and Materiality

Strategic Positioning of Medium-Term Management Plan 2027

- We have moved the target year for our medium- to long-term goals from FY2030 to FY2034 while establishing specific numerical performance targets

- In anticipation of demographic changes, we will restructure our business framework and target sustainable growth

Business Objectives and Financial Strategy

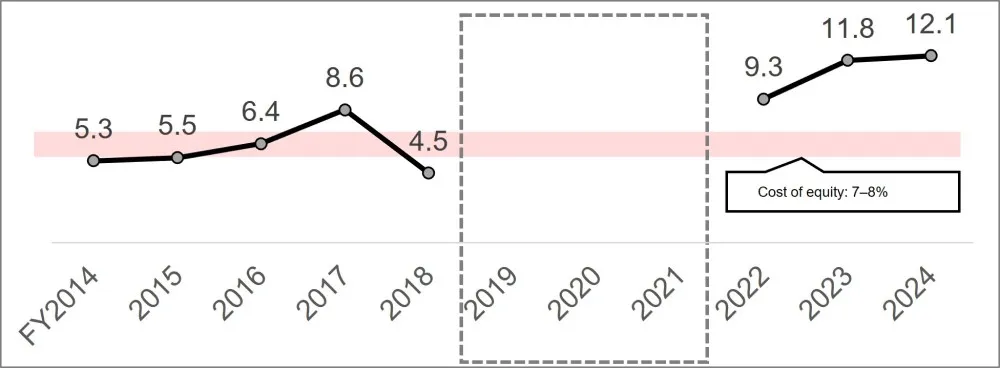

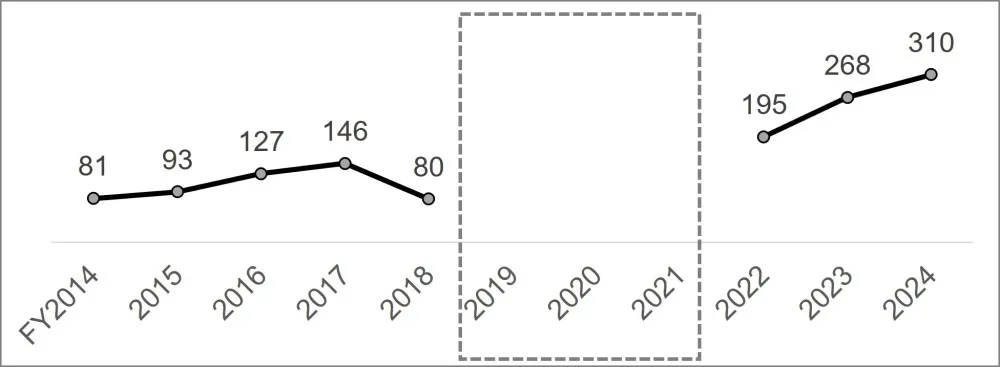

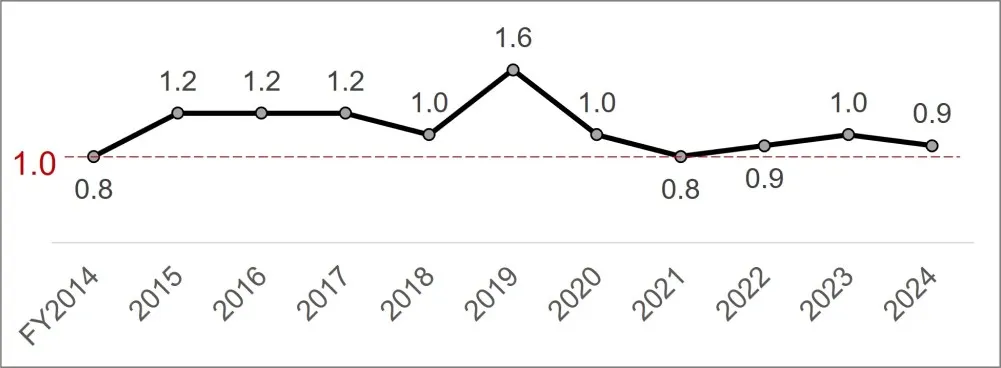

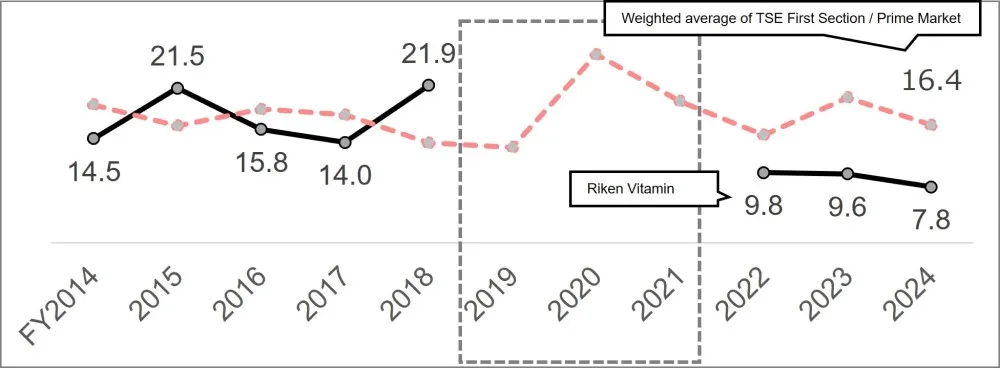

Management Conscious of Cost of Capital and Stock Price: Analysis of Current Situation

- ROE and EPS improved mainly due to an increase in operating profit and the sale of cross-shareholdings

- Share price growth has stalled, our PBR is below 1.0, and our PER remains low

-

ROE (%)

-

EPS (JPY)

-

PBR (Multiples)

-

PER (Multiples)

- Calculated based on actual fiscal year-end results

- The area enclosed by the dashed lines is excluded due to losses and/or abnormal values resulting from accounting issues associated with a subsidiary

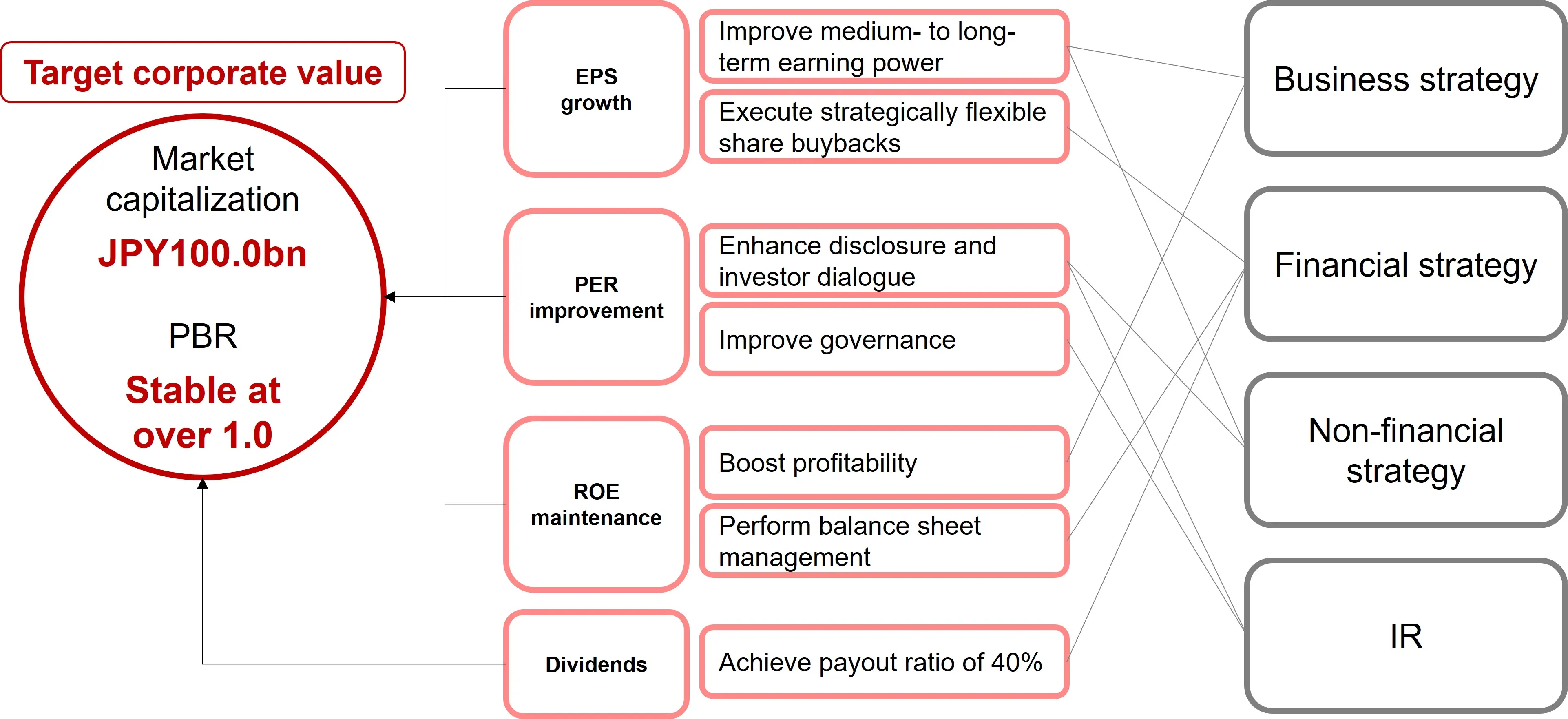

Approach Toward Corporate Value Enhancement

- Our PER is one of our most pressing strategic priorities

- We aim to raise our anticipated rate of growth by improving earnings momentum (EPS), maintaining ROE, and strengthening investor communication

Numerical Targets

| KPIs | FY2024 actual |

FY2027 target |

|

| Growth potential | Net sales | 95.5 | 110.0 |

|---|---|---|---|

| Profitability | Operating profit Operating profit margin |

8.7 9.1% |

10.0 9.1% |

| EBITDA (Operating profit + depreciation) | 11.9 | 14.2 | |

| Efficiency | ROE | 12.1% | 10% or more |

| Shareholder return | Payout ratio | 30.3% | 40% or more |

| Financial discipline | Shareholder equity ratio | 70.1% | 60–65% |

| Governance | Cross-shareholdings to net assets ratio | 19.0% | Less than 10% |

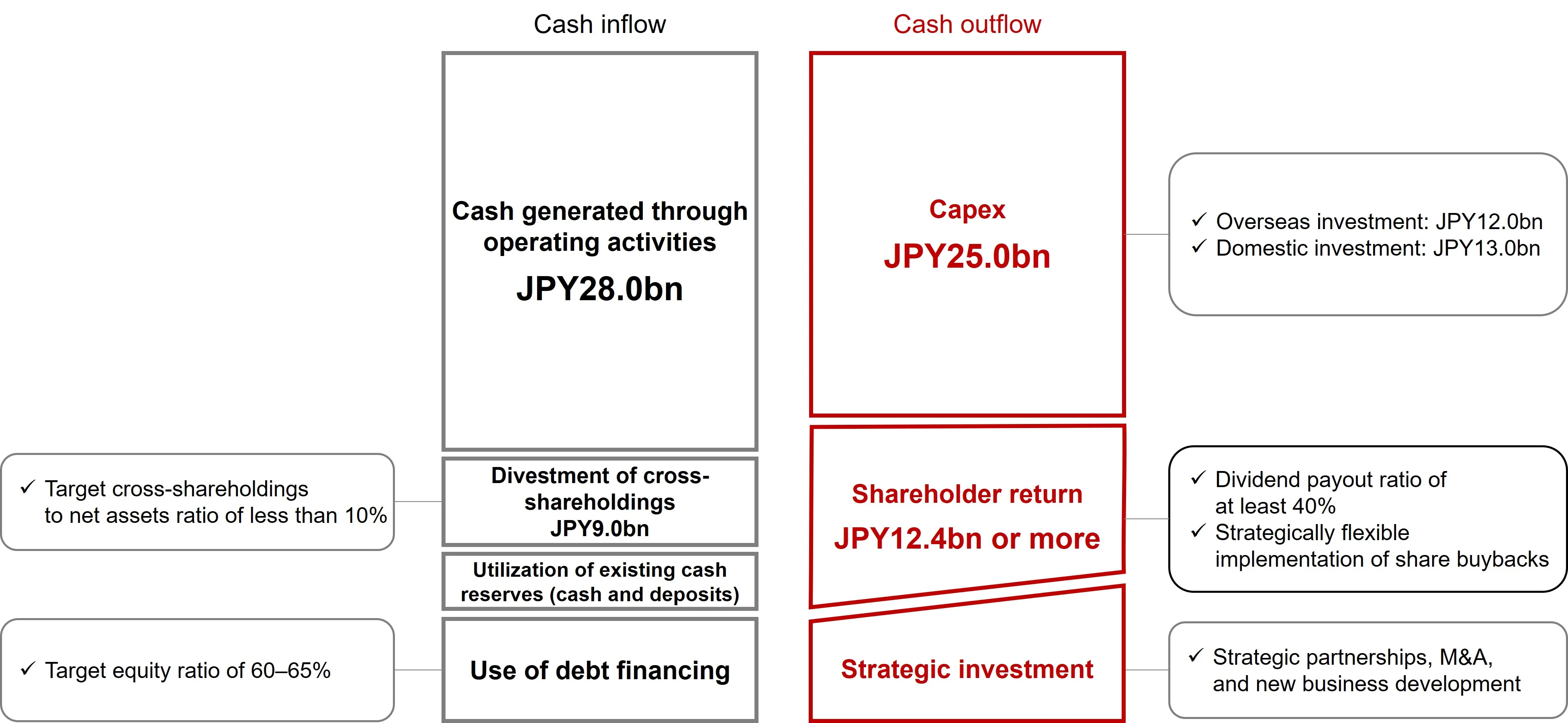

Cash Allocation

- Leveraging cash from operations and divestments of cross-shareholdings, we will proactively invest while enhancing shareholder return

- When deemed in alignment with strategic needs or objectives, we will selectively utilize debt to finance strategic investments

Capex Breakdown

- Through investment in domestic infrastructure and overseas growth, we will strive to build optimal production systems

- Allocate funds primarily toward improving agents and associated operations

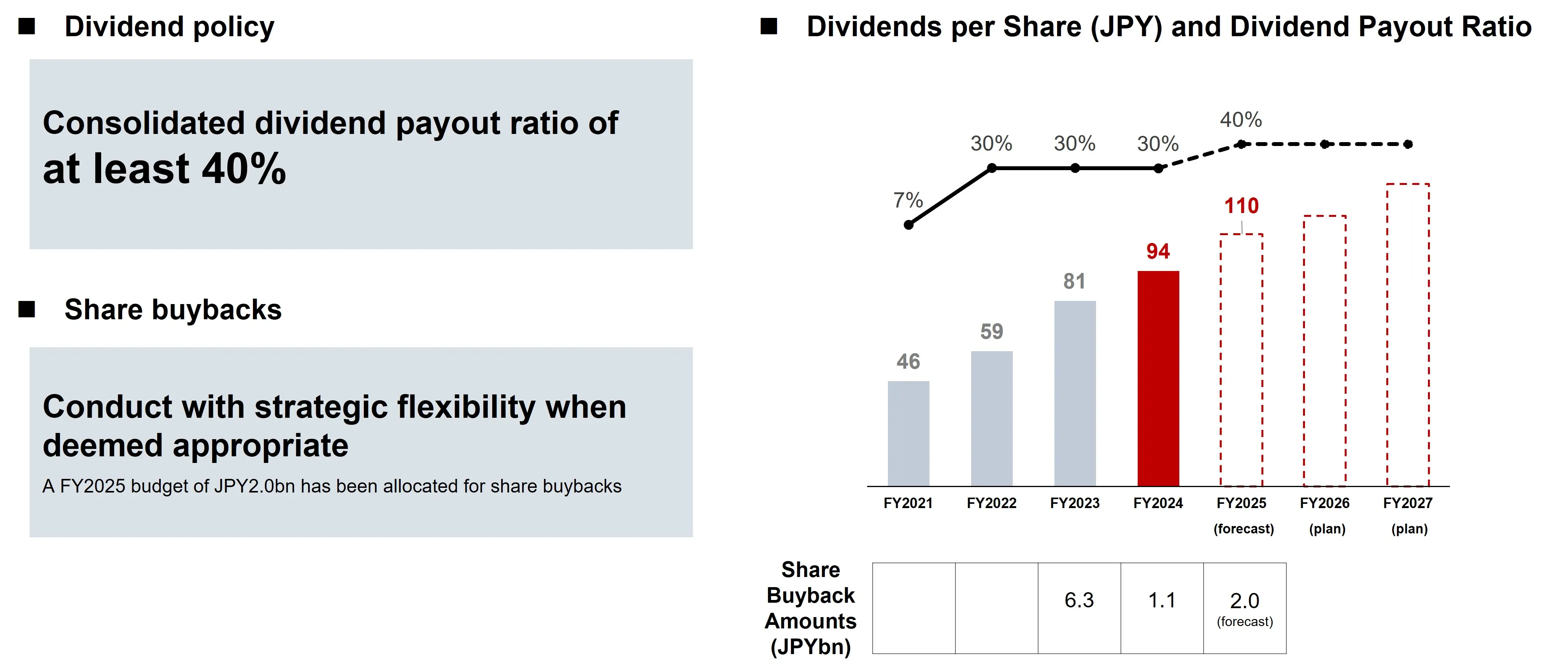

Shareholder Return

- We have raised our target consolidated dividend payout ratio

- The Company will execute share buybacks with strategic flexibility

-

■ Dividend policy

Consolidated dividend payout ratio of

at least 40%■ Share buybacks

Conduct with strategic flexibility when deemed appropriate

A FY2025 budget of JPY2.0bn has been allocated for share buybacks

-

■ Dividends per Share (JPY) and Dividend Payout Ratio

Business Strategy

Awareness of Business Environment

- Our fundamental awareness regarding our business environment remains consistent with our previous Medium-Term Management Plan

- We are confident tackling environmental and social issues will generate growth

-

Demographic changes

Japan’s population is declining and aging,

while the global population is increasing. -

Lifestyle changes

The processed food market is

slowly expanding. -

Climate change

Risks associated with raw material procurement

and natural disasters are on the rise. -

Increasing uncertainty

Forecasting the future is becoming

increasingly challenging.

Domestic Food business

| FY2024 result | FY2027 target | |

|---|---|---|

| Sales | JPY64.8bn | JPY71.9bn |

| Operating profit | JPY6.6bn | JPY7.5bn |

- Target slightly higher growth than the processed food market as a whole

- Perform capital investment targeting improved productivity and reduced labor dependency

- Household Food: Develop and nurture market-creating products while revitalizing our existing product portfolio

- Commercial Food: Strengthen tailored solutions for the prepared meal market, the ready-to-eat product market, and newly emerging markets expanding due to labor shortages

- Processed Food Ingredients: 1) Strengthen solution portfolio to facilitate stable ingredient sourcing alternatives, improve productivity, and reduce food loss; 2) Enhance lineup of solutions targeting health-related markets

Domestic Chemical business

| FY2024 result | FY2027 target | |

|---|---|---|

| Sales | JPY7.9bn | JPY9.7bn |

| Operating profit | JPY0.8bn | JPY0.9bn |

- Focus on our core areas of strength and deepen our engagement in the domestic market

- Enhance our solutions for Japanese companies conducting business abroad

Overseas business

| FY2024 result | FY2027 target | |

|---|---|---|

| Sales | JPY24.1bn | JPY30.0bn |

| Operating profit | JPY1.1bn* | JPY1.6bn |

*Changed in the calculation method for segment profit adjustments. Figures for FY2024 have been retroactively adjusted to reflect this change.

- Prepare for upcoming growth in the specialty products market by executing proactive investment with an emphasis on speed

- Focus investment on key factory, Rikevita (Malaysia) Sdn. Bhd.

- Establish a business foundation through close collaboration with domestic departments

- Reorganizing product lines in China and target early operational capacity expansion at our new plant

Non-Financial Strategy

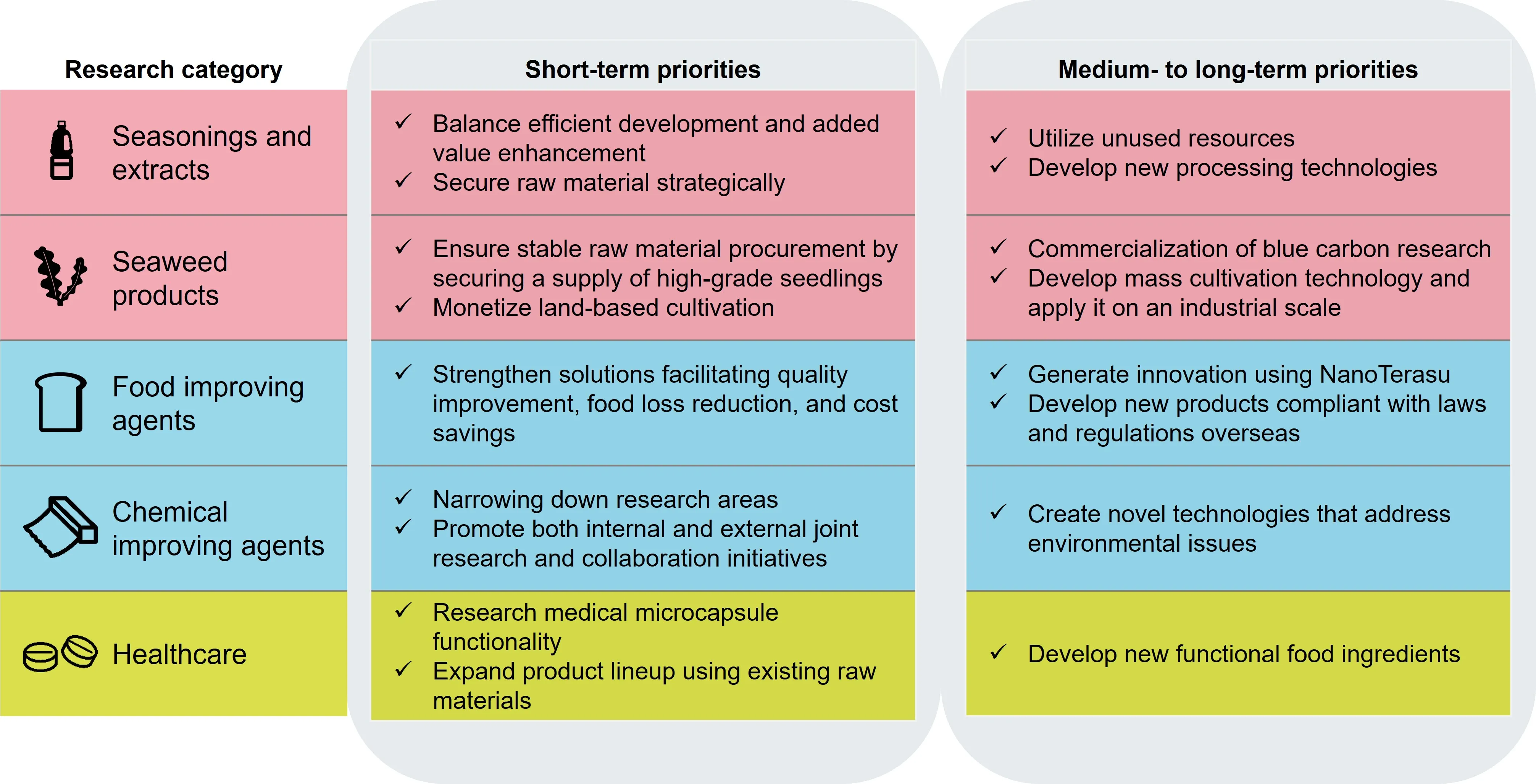

Intangible Asset Enhancement: Creating Value Through Research and Development

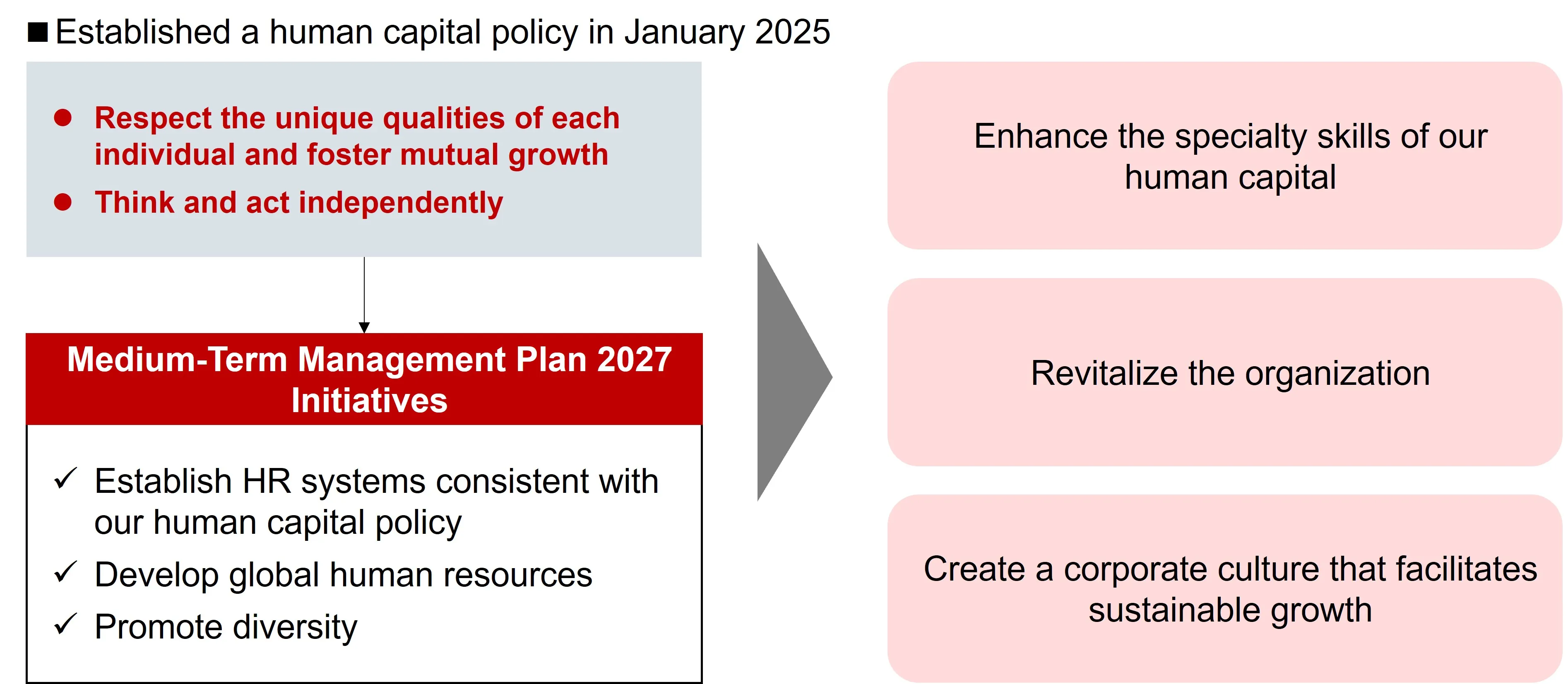

Intangible Asset Enhancement: Human Capital

- Enhance the specialty skills* of our human capital and increase corporate value

*Refers to personnel individuality, including both innate diversity and the experience, knowledge, and skills acquired or developed after joining the Company

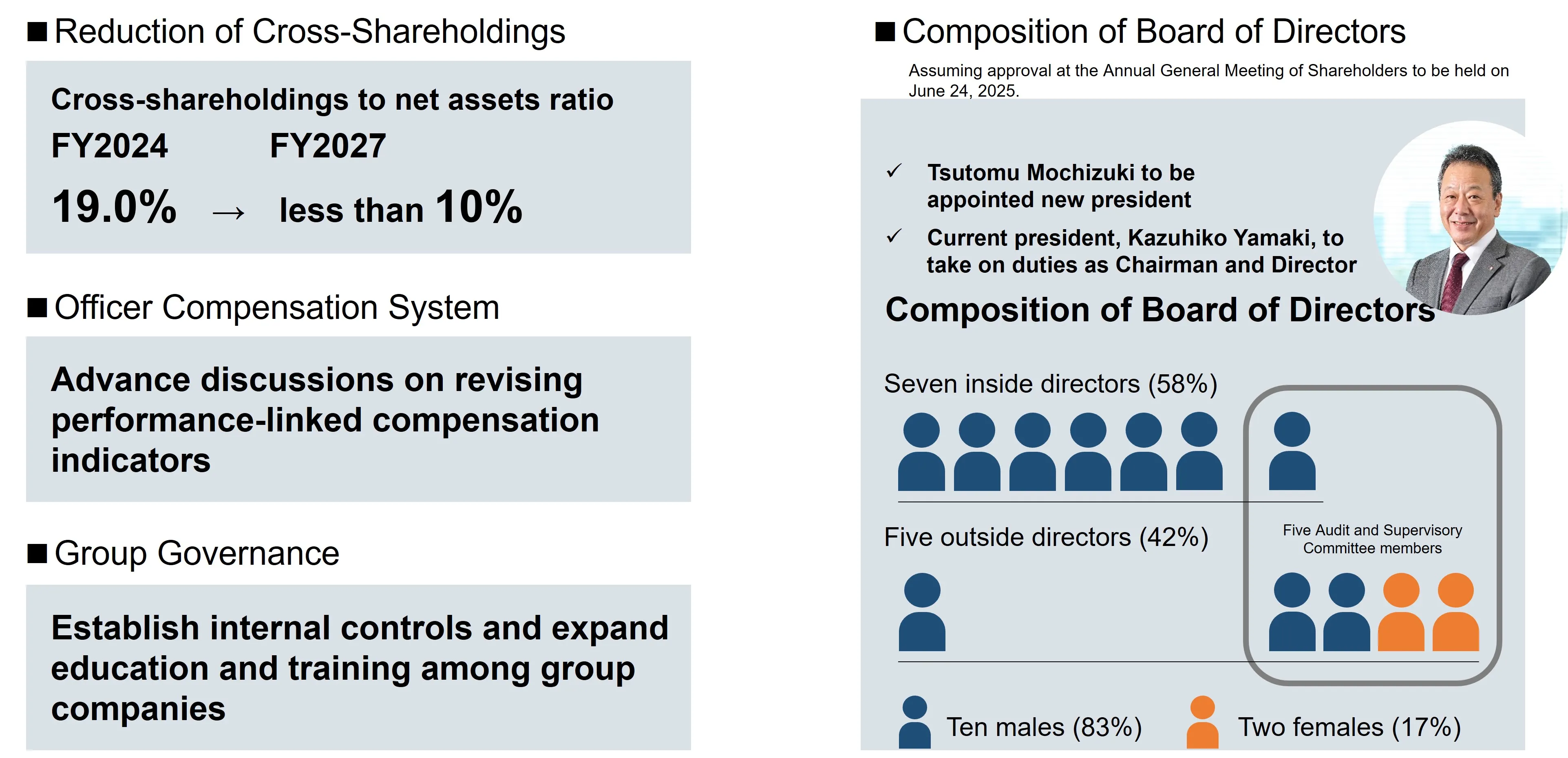

Governance Enhancement Initiatives

-

■ Reduction of Cross-Shareholdings

Cross-shareholdings to net assets ratio

(FY2024)19.0% → (FY2027)less than 10%■ Officer Compensation System

Advance discussions on revising performance-linked compensation indicators■ Group Governance

Establish internal controls and expand education and training among group companies

-

■ Composition of Board of Directors

Assuming approval at the Annual General Meeting of Shareholders to be held on June 24, 2025.